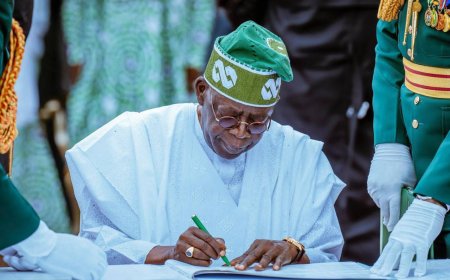

WHY TINUBU TAX REFORM IS NIGERIA NEEDED RE-ENFORCEMENT TO GROWTH AND DEVELOPMENT

Prof. Sunday. C. Enubuzor, Ph.D, 24th December 2025.

President Tinubu's tax reform is a game-changer for Nigeria's growth and development. The new tax laws aim to boost revenue generation, improve compliance, and foster a business-friendly environment.

Thus, below are some key highlights of the tax reforms:

- Simplified Tax Structure: The reform introduces a more progressive Personal Income Tax (PIT) regime, exempting individuals earning ₦800,000 or less annually from tax.

- Support for Small Businesses: Small companies with annual turnovers of ₦100 million or less are exempt from Companies Income Tax (CIT), Capital Gains Tax (CGT), and the Development Levy.

- Increased Capital Gains Tax: The CGT rate for companies has been increased from 10% to 30%, aligning it with the Companies Income Tax rate.

- Digital Taxation: A digital services tax targets multinational tech companies, modernizing Nigeria's tax structure and aligning it with global standards.

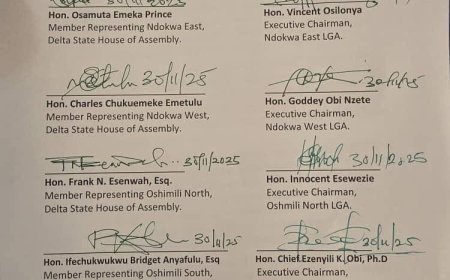

- VAT Revenue-Sharing Formula: The new formula allocates 60% of VAT revenue to the state where goods and services are consumed, 20% based on population, and 20% equally shared among states.

THE PURPOSE OF THE REFORMS ARE TO:

- Boost Economic Activity: Reduce financial burdens on vulnerable groups and small enterprises, enabling them to reinvest in growth.

- Enhance Fiscal Autonomy: Empower states and local governments to develop their internal revenue-generating capacities.

- Promote Transparency and Compliance: Improve tax administration, reduce corruption, and increase revenue for essential services.

While there are concerns about implementation and regional disparities, economists and tax experts believe the reforms can drive sustainable growth, improve infrastructure, and enhance social services if executed effectively.

What's Your Reaction?